Confirming payment details

Payment processing

Login or Sign up

Forgot password

Enter your email address and we will send you a password reset link or need more help?

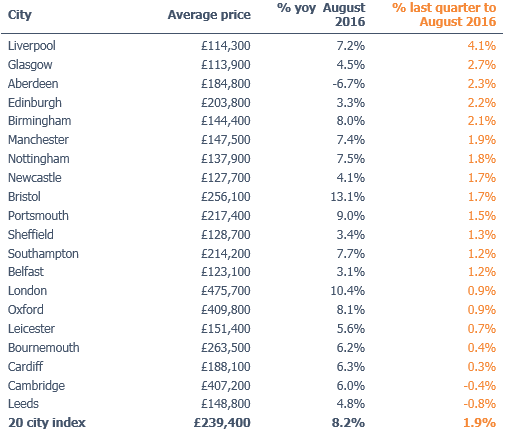

August 2016 Hometrack UK Cities: UK city house price inflation slows to 8.2%

On 23 September, 2016- The 20 city Index recorded its lowest level of quarterly growth (1.9%) for six months

- London house price growth on course to end 2016 at +6% yoy but with slower underlying rate

- Cities with short-lived recoveries registering fastest growth – Liverpool and Glasgow

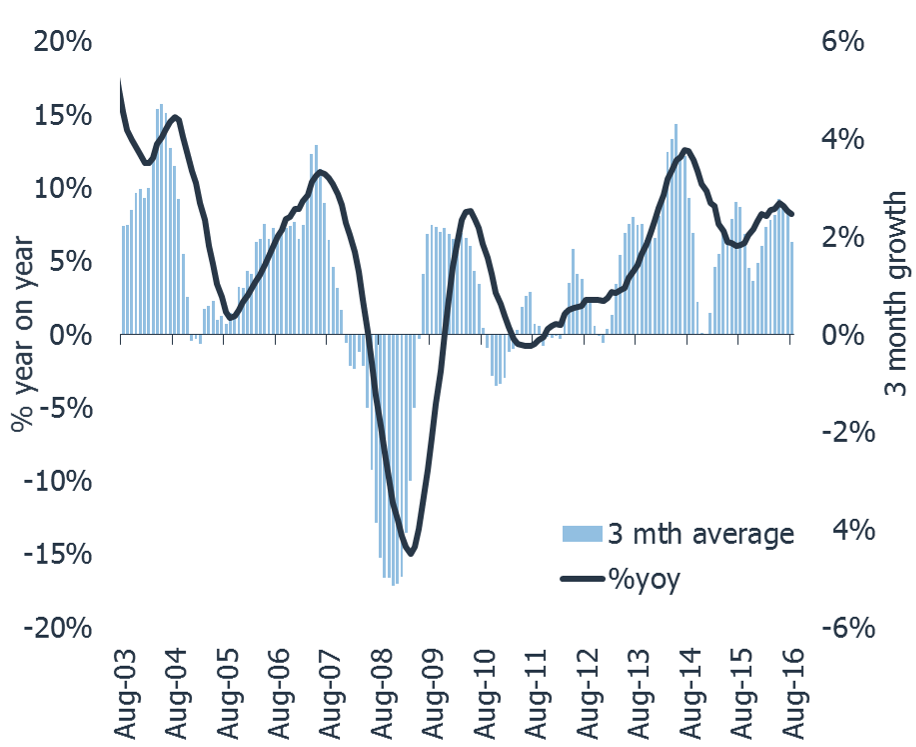

The latest Hometrack UK Cities Index reveals house price growth has fallen to 8.2% as the slowdown seen in cities across the south of England in recent months intensified in August.

The 20 city Index recorded its lowest level of quarterly growth for 6 months as a seasonal lull in market activity combined with weaker demand post Brexit and the April Stamp Duty change reduced the rate of house price growth.

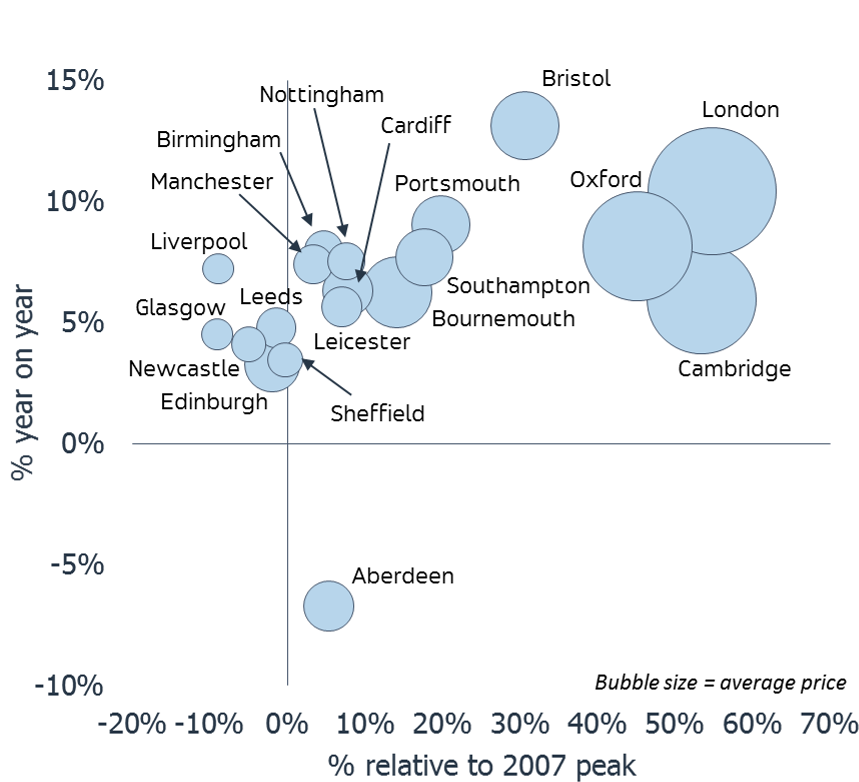

Bristol continues to register the fastest rate of annual growth (13.1%) followed by London (10.4%) but growth in both cities is slowing. A similar trend is evident in most cities located in southern England including Cambridge, Oxford and Bournemouth where annual growth has eased in the last few months. Cambridge has registered the fastest deceleration in growth from an annual rate of 16% in March 2016 to just 6% today as affordability pressures and weaker investor demand impact growth.

The city housing markets with the strongest underling rates of growth remain those that have some of the lowest prices and where the pick-up in prices has been running for the shortest period of time. Liverpool and Glasgow have recorded the fastest growth in the last three months where average house prices of £114,000 are more than half the price of the 20 city average (£239,400).

Over the last three months house prices in the capital increased by a modest 0.9%, more than half the quarterly average (1.9%) for all 20 cities over the last 12 months. A more granular view of London reveals the lowest rates of annual growth are in the highest value, inner London boroughs – Kensington & Chelsea (0.2%), Hammersmith and Fulham (1.0%), Westminster (1.8%), Wandsworth (4.1%) and Camden (4.4%).

Richard Donnell, Insight Director at Hometrack says: “On current trends house price growth in London will be running at c.6% per annum by December and on course for low single digit growth by spring 2017. Record unaffordability, tax changes impacting investor demand and high stamp duty costs are all combining to reduce market activity in the face of rising supply.

“Despite the overall slowdown in London, it is dangerous to view the capital as a single housing market. While many of the central boroughs have seen low rates of growth, in parts of outer London where house prices are 30% lower than the London average, such as Barking and Dagenham and Havering, prices are rising by more than 15 per cent although these areas are starting to slow.

“Regional cities such as Glasgow, Liverpool, Birmingham and Edinburgh have all posted above average growth in the last three months as low mortgage rates and affordable property prices support growth. Aberdeen has registered a small bounce back in house prices - after house prices registered a £20,000 fall since July 2015 – the rebound in growth reflects the fact that the recent fall in the oil price has now been priced into capital values.”

The latest Hometrack UK Cities Index reveals that in the three months to September house price inflation in London recorded the lowest quarterly growth for 20 months.

London, Tuesday 13th September: Hometrack has been appointed by digital challenger bank, Atom, to provide a range of Automated Valuation Model (AVM) services.

The latest Hometrack UK Cities House Price Index reveals a marked slowdown in house price growth over the last three months, led by a deceleration in London and other high value cities across the south of England.

The latest Hometrack UK Cities House Price Index reveals that annual house price inflation plateaued at 10.2% in June, the same level as May 2016, but still ahead of 6.9% growth seen in June 2015.

Subscribe to receive email updates.

HometrackGlobal:

Linked In: