Confirming payment details

Payment processing

Login or Sign up

Forgot password

Enter your email address and we will send you a password reset link or need more help?

Research: Unlocking strategic asset management in social housing

On 24 May, 2016The operating environment for housing associations has changed in the face of an evolving policy environment over rent levels, right to buy and funding for new housing delivery.

Executives need to consider a broader range of factors as they evaluate strategy and develop business plans for their assets set in a wider market context.

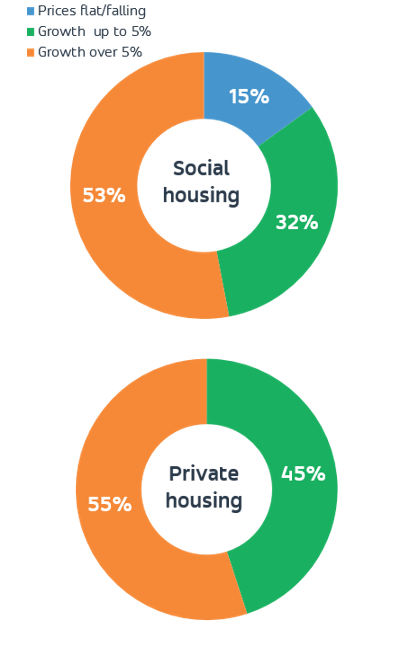

De-regulation and the shift towards mixed tenure regeneration and new development means housing associations are considering multiple price points for assets as they develop strategies and business plans.

This report presents unique analysis on the market value of social housing and how this relates to social and affordable rents and the attractiveness of intermediate tenures at a localised level and the key implications for strategy.

The analysis highlights how big data and market analytics used by mortgage lenders and other property sectors can be applied to the affordable housing sector.

Download the PDF below to read the full article.

This research was first presented at the Social Housing Finance Conference, May 2016.

Research: Unlocking strategic asset management in social housing

In the wake of the Brexit vote all eyes are on market data that can provide some sense of direction for what the impact on the housing and mortgage markets will be.

The housing market has been at the centre of a storm in recent years. From rent cuts for housing associations, to extending the Help to Buy scheme, and tax changes aimed at curbing investor demand, all types of organisations have had to react to a plethora of policy changes.

Brace yourself for a brave new world in the mortgage market, because it’s here. Anyone in our industry that has been following the ceaseless march of technology won’t have failed to notice some significant announcements this year.

The decision to leave the European Union means the near term prospects for the UK housing market now look very uncertain.

Subscribe to receive email updates.

HometrackGlobal:

Linked In: